BREAKING NEWS: The Window of Opportunity is Closing for Property Investors

Australians have long had a love affair with property. Myself, I borrowed $86k at an interest rate of 17% to get into the market, and I thought back then I would be hard-pressed ever to buy anything again. But I learnt to identify and, more importantly, capitalise on “ Windows of Opportunity” to catapult my wealth using property. Right now, I am looking at you through one of those “windows”.

It’s the $9.3T question in Australia right now – What will happen to property prices in 2023 and beyond?

It’s no secret that Australia is amid a raging debate on housing affordability and a rental crisis leaving everyday Australian families facing the real prospect of homelessness, all whilst the media is telling the masses that property is set to drop by 50%.

With over three decades of property investing experience and a multi-million-dollar portfolio of my own, I can say that right now, a “small window of opportunity” exists for property investors to capitalise on the current market conditions that will lead to price growth in the very near term.

The Only Thing Stopping a Property Boom Right Now?

Do you know the number one ingredient for a property boom? It’s confidence.

Interest rates are the primary concern for prospective property purchasers, with many concerned about whether the repeated rise in rates will burden their cash flow and ability to hold the assets over the long term.

As we adapt to the new financial landscape that has included 11 consecutive interest rate rises, the media has done a great job at undermining confidence with the narrative that Australian households run a real risk of defaulting on their current mortgage commitments.

Whilst I acknowledge the potential of mortgage stress for a particular market segment, we must remember that finance applications over the past several years have continually been assessed with a 3% buffer on top of the interest rate at the time.

Furthermore, recent comments from Suncorp Bank’s and ANZ Bank’s CEO add further weight to my assessment that the risk of mass mortgage stress is significantly low.

Suncorp chief executive Steve Johnston said last week that “Almost a third of Suncorp’s bank customers were more than a year ahead of their repayments”, which was echoed similarly by ANZ chief executive Shayne Elliott also said the bank’s customers were in “good shape”, noting that the number of ANZ home loan customers who were more than three months behind on their mortgage payments was “extraordinarily low”, at about 0.5 per cent of borrowers.

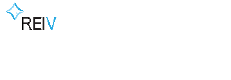

As you can see from the below chart, mortgages in arrears remain well below the historical averages.

With interest rates looking to stabilise in 2023 and Australians becoming more comfortable with a “new normal” level of interest rates, expect confidence to flick like a switch with the dynamics of the market changing rapidly from a buyer’s market to a seller’s market.

Yields for Today’s Investors are off the Charts.

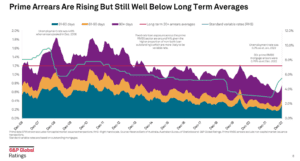

The other dominating factor in the headlines is Australia’s current lack of rental housing. This lack of housing market has seen weekly asking rental amounts skyrocket, with some Australian capital cities seeing over a 12% increase in the past twelve months.

As demonstrated in the below chart obtained by CoreLogic, rental prices across the combined capital cities have increased by 11.1 providing increased cash flow for property investors nationwide.

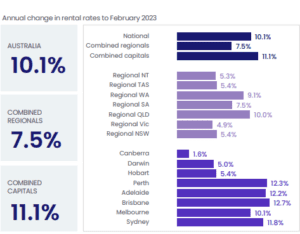

Combined with a record low vacancy rate of just 1.43% nationwide, many predict a further 10%+ increase in rental prices in the coming twelve months.

With property prices adjusting slightly after the boom and minor retraction in the past 12 months, property investors can take advantage of the attractive proposition of discounted prices with increased rental yields.

The Fundamentals of the Last Property Boom are Still Present.

The primary factor in whether property prices boom is supply vs demand. In the last boom, we saw a pent of demand unleashed into the market due to prospective purchasers delaying the purchase of real estate due to financial policy, elections and the onset of the pandemic.

This demand built up to a point whereby the shackles eventually broke, eventuating in one of the biggest property booms Australia has ever seen.

History can teach us many things, and we’d be naive to think that the same thing will not happen.

Demand is slowly intensifying as people put off purchasing due to fear of interest rates. With every day passing, more water gets added to the kettle, and the flame beneath it intensifies.

Add over 200,000 new international immigrants to the equation, and those metaphorical shackles are already starting to crack.

As well as a pent-up of demand, there is also a tightening of supply as sellers continue to hold their properties until they believe the market is at its peak.

In a recent survey by Canstar, 70% of homeowners advised that they intended to hold their properties for the next few years, putting a constraint on supply.

In a further boost for property investors, in that same survey, 60% of respondents said they expected house prices to remain stable, grow or possibly even skyrocket at some point before the end of 2024. Again, this underlines the confidence in the property market from the public.

The Window of Opportunity is NOW!

With a multi-million property portfolio of my own, I’ve seen 30+ years of property cycles. But, from over three decades of experience and guiding Australians to financial independence through real estate, I can tell you the market is on the precipice of shifting.

In fact, it has already started shifting. The property market works in cycles, and more often than not, the capital city markets often follow each other, led predominantly by Sydney.

Historically, Sydney will be the first to grow in value, followed by Melbourne and Brisbane, with other capitals following after that.

The most recent data has suggested that Sydney property prices grew by 0.3% last month. This could be the start of the next property cycle, resulting in another property boom.

I ask potential investors to consider this;

- If you could have your pick of the best possible properties right now – would it be a good time to invest?

- If you could purchase the best properties at a discounted price – would it be a good time to invest?

- If you could purchase the best property at a discounted price with an above-average rental yield – would it be a good time to invest?

- If you could purchase the best property at a discounted price with an above-average rental yield in locations with mass population growth, solid infrastructure and demographic fundamentals – would it be a good time to invest?

If you answered yes to any of the above questions, download our free “investor guidebook” to understand the ins & outs of creating wealth through property.

Download your copy today : https://nationalinvestmentadvisory.com.au/ebooks/investor-guidebook/