It’s the tale of two sides of the coin as the population boom in Australia, fuelled by the Albanese Government’s immigration agenda, is expected to have a significant impact on the property market, pushing rents up and house values through the roof.

As more migrants arrive in the country, there will be a higher demand for housing, both for sale and rent, which will likely drive-up property prices.

New Treasury data has revealed that 650,000 new migrants will be welcomed to the country over the next two years, in addition to the 400,000 new immigrants that called Australia home in 2022. This immigration deluge has been intentionally engineered by the Albanese Government, which made a range of policy changes after last year’s election to turbo-charge the numbers of international arrivals.

Undoubtedly, migration provides a significant upside to the economy and Australia’s balance sheet. For example, data from the Grattan Institute outlines how just 40,000 skilled migrants would add a $38 billion boost to federal and state governments over the next decade. That’s a budget-saving equivalent to cutting negative gearing.

How Will the Rental Market Fair?

One of the immediate effects of the increased population is the pressure on the rental market. Australia’s already strained rental market, characterised by high demand and low vacancy rates in many major cities, is expected to face further challenges with the influx of migrants.

As more people compete for limited rental properties, the increased demand will likely drive-up rents, making it harder for lower-income earners and families to afford housing.

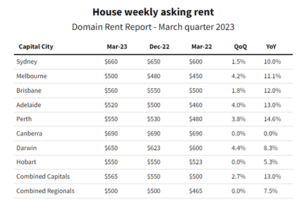

Australia’s rental market is already under significant pressure. As outlined in the “Domain Rent Report,”. Rents have risen across Australia’s combined capital cities by a staggering 13% in the past twelve months, creating additional cash flow for property investors.

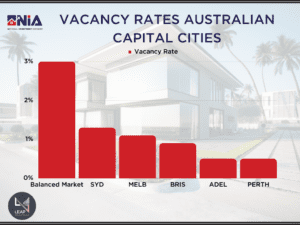

In addition, the vacancy rates in Australia, particularly in major cities such as Sydney, Melbourne, Brisbane, Perth, and Adelaide, are alarmingly low, with some cities experiencing rates well below 1%. For example, according to the latest data, Sydney has a vacancy rate of 1.3%, Melbourne at 1.1%, Brisbane at 0.9%, and both Perth and Adelaide at 0.5%.

In saying that, the regions are not immune to rental shortage either; with the work-from-home revolution in full swing, regional hubs such as Geelong, Toowoomba and Ballarat which many of our clients have invested, have also seen vacancy rates plummet, and rents increase sharply.

A balanced rental market typically has a vacancy rate of around 3%, signifying a severe supply shortage in the current market. Therefore, adding further demand to the rental market will only see prices rise rapidly and competition increase.

How Will This Affect Property Prices?

Property owners are set to profit from the increased demand for housing. As a result, property prices are expected to rise as more people look for housing, both to buy and rent.

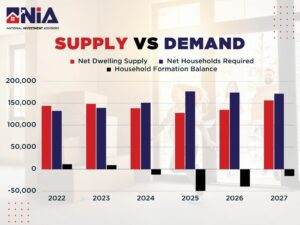

The balance of supply VS demand ultimately determines the real estate market. As the population grows, so should the supply of dwellings to house the influx of new residents.

Right now, in Australia, this is not happening. As the data below highlights, Australia will face an undersupply of 124,100 Dwellings by 2028.

This data will likely lead to a direct rise in property prices and will create a favourable environment for property investors, who will also see higher rental incomes. As the yields increase and prices grow, the proposition for property investors will seem increasingly attractive, and sales activity will undoubtedly increase.

In particular, areas with higher population growth and increased demand for housing, such as major cities and regions with strong employment opportunities, good infrastructure, and convenient amenities, will see a surge in property prices.

As property prices continue to rise, property investors are likely to reap the benefits of the population boom in Australia. With higher demand for housing, both for sale and rent, property owners can expect increased rental incomes and potentially higher returns on their investments. Additionally, areas with strong population growth and demand for housing, such as major cities and regions with favourable economic conditions, are expected to experience a surge in property prices, providing lucrative opportunities for property investors.

However, the population boom and its impact on the property market also raises concerns about affordability and accessibility for lower-income earners and families. The already strained rental market, characterised by high rents and low vacancy rates, may become even more challenging for those struggling to afford housing.

Those with the capacity to invest in property should be mindful of their ability to secure a financial future for not only themselves but their families. This mass increase in migrants will undoubtedly lead to a robust market, kicking off the next property boom.

In conclusion, the population boom in Australia, driven by the Albanese Government’s immigration agenda, is expected to impact the property market significantly. It is a tale of two sides, for those who own property or can invest are in a great position to catapult their financial position. However, those who are not face increased difficulty stepping onto the property ladder.

Find out how you can take advantage of this wave of new Australians by visiting www.nationalivnestmentadvisory.com.au