You’ve heard the age-old saying, “What goes up must come down,” but does this adage hold true in the world of interest rates? It’s a bit like predicting the weather, isn’t it? Just when you think you’ve got it figured out, the forecast takes an unexpected turn.

In this blog post, I will delve into the latest forecasts by major banks, delve into historical trends and insights, and, most importantly, explore how savvy property investors can safeguard themselves against the ups and downs of real estate cycles.

In recent times, even the savviest economists have had their crystal balls in a bit of a haze. However, for investors with the right guidance and structures in place, the presence of a crystal ball should be inconsequential in the long term.

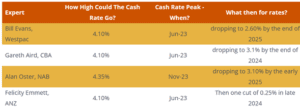

What Are The Big 4 Banks Predicting?

The big four banks have thrown their hats into the ring, each offering their own take on where the cash rate is headed.

It’s like a financial guessing game, with predictions ranging from hopeful to cautious. But, as we all know, the financial world has a way of throwing curveballs that can make even the best predictions look like guesswork.

The Reserve Bank of Australia (RBA) has been on a mission to tackle inflation by hiking rates, after keeping them at “wartime” stimulatory levels during the pandemic.

However, the RBA’s recent forecasts are painting a picture of optimism. They’re talking about declining inflation, a growing economy, modestly rising unemployment, and better wages.

In simpler terms, it seems like the RBA is gearing up for economic growth without the need for further rate hikes.

Many experts are suggesting this sweet spot could be somewhere between 3.25% to 3.5%.

What Does History Tell Us

Journalist Tarric Brooker recently turned to history for some insights. He took us on a journey through the last six decades of Australian interest rates, highlighting 11 rate cut cycles. The catch? These cycles had varying degrees and durations of rate cuts, making it clear that predicting the path of Australian interest rates is about as precise as predicting the winning lottery numbers.

So, what can history tell us? Well, it reveals that rate cuts have had different impacts on mortgage repayments over time, with an average reduction of 18.0% across various cycles. The duration of high rates after their peak has ranged widely, from just three months to a whopping 16 months.

But here’s where it gets really interesting. The degree of rate cuts varied too, from a modest 0.25% cut in 1975 to a jaw-dropping 8.25% reduction in the early ’90s. It’s like the difference between a gentle breeze and a full-blown storm.

Based on historical patterns, Brooker offers up some projections for potential future rate cuts. In an average scenario, we might see mortgage rates drop to around 5.0% from an anticipated peak of 6.5%. In an extreme scenario, reminiscent of the ’90s recession, they could plummet to around 3.35%. But, remember, history may rhyme, but it doesn’t always repeat.

Why Investors Should Not Be Trying to Predict Interest Rates

In a nutshell, predicting interest rates is a bit of a puzzle right now. It’s a complex, unpredictable game that even the experts can’t fully decipher.

Those who find themselves vulnerable to rising interest rates or are relying on rate cuts to meet their next payment are already facing a challenging situation. You see, fluctuations in interest rates are inevitable and occur repeatedly. It’s essential to establish buffers and strategies that enable you to maintain your real estate holdings as you navigate periods of elevated rates.

While the days of sub-3.25% mortgage rates might be behind us, understanding the context and being prepared for what lies ahead can help you navigate with confidence.

It’s crucial to conduct a thorough portfolio review, seek guidance from a qualified finance professional, assess your current interest rates, and ensure you have the appropriate structures in place.

Currently, we are witnessing consistent property price growth across Australia, with prices increasing for seven consecutive months. However, there’s a puzzling trend of investors exiting the market in record numbers.

Why is this happening? It’s not because they don’t want to remain in the market and hold onto their properties; rather, it’s because they lack the financial structures needed to weather the long-term increase in interest rates.

A successful portfolio should have the resilience to navigate market fluctuations.

To discover more about how to position your property for growth, please reach out to our team at www.nationalinvestmentadvisory.com.au.