New data sourced from CoreLogic reveals that the number of Australian’s making a profit out of property has risen to over 92%. This signifies the dynamic market currently being experienced collectively Australia wide.

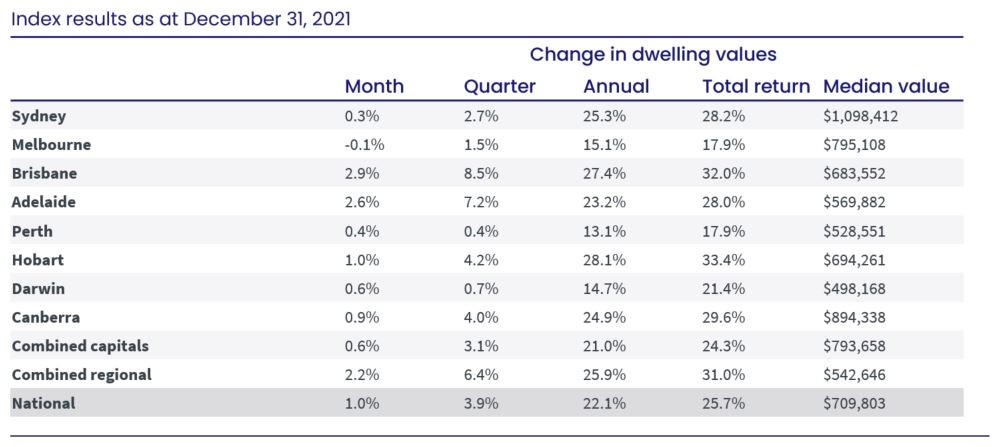

With dwelling values showing further increases nationally through the December 2021 quarter, the portion of profit-making sales is expected to continue rising in the coming quarters. In 2021, investors enjoyed the sharpest rise in property prices since the 80’s. Yes, you read that right the 80’s.

As I’m sure you can appreciate when you have a market moving faster than any other time in the past 3 decades it’s going to put constraints on affordability. It’s important to realise that this growth is not sustainable and you shouldn’t base your decisions expecting this outcome year in year out.

Prices in Australia’s two most expensive capital cities are expected to be affected by affordability constraints and negative interstate migration. As a result, you’d expect the velocity of rising prices to ease to more realistic levels of 6-8% per annum.

The slowing trend in Sydney and Melbourne can be explained by bigger deposit hurdles caused by higher housing prices alongside low-income growth.

In Brisbane, housing affordability is less challenging, advertised stock levels remain remarkably low and demographic trends continue to support housing demand.

Furthermore, we may be looking at a market in 2022 in what I call “multi-speed”. Whilst growth in Melbourne & Sydney may slow, we may see the momentum continue to rise in cities like Brisbane and regional areas. These regions show less of an affordability challenge relative to the larger capitals, as well as better support for housing demand with Queensland showing strong interstate migration.