⏱️ Your eBook will be in your email inbox in a moment.

In the meantime...

Claim your complimentary Property Wealth Strategy Session below 👇

SESSIONS STILL AVAILABLE

DISCOVER IN A FREE PROPERTY WEALTH STRATEGY SESSION:

How we help Aussie families retire wealthy using property.

Slash tax. Cut years off your mortgage. Build real wealth.

Secure your complimentary 60 minute 1:1 session:

EXPERIENCE

With 18+ years experience, NIA have proudly helped over 500 Aussie families build the kind of wealth that gives their grandchildren an advantage in life.

CONFIDENCE

SUPPORT

AS FEATURED IN

Will you be toasting to the good life?

Retirement spent celebrating, or stressing?

July 27, 2024

Or it’s something as simple as being able to afford a holiday home. Having BBQs with your kids. Watching the grand kids grow up.

Maybe for you, it’s having the power to decide for yourself:

To work, or not work.

Freedom from worrying about bills coming in.

Feeling safe, secure and in control of your financial situation.

Yet this is exactly the kind of opportunity that Australia’s property market presents us with right now.

But it is a time sensitive opportunity.

The longer you sit on the sidelines, the more difficult success becomes.

We’re here to make sure you’re not one of them.

Here’s the thing you must know.

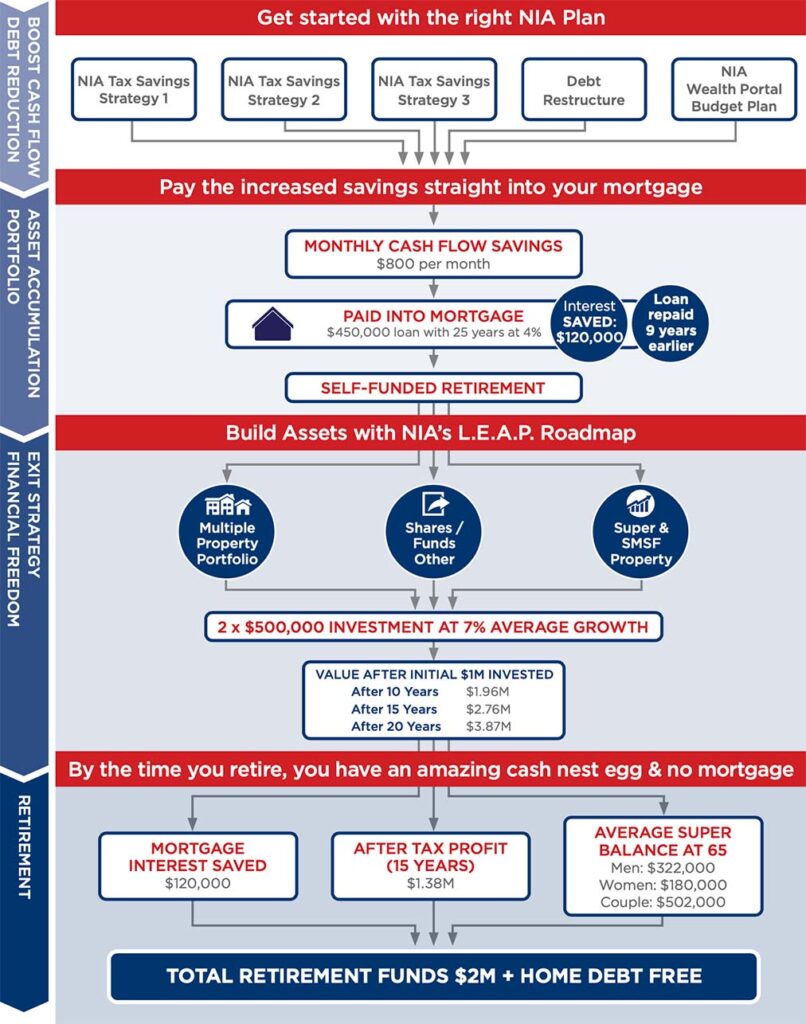

- We'll understand your financial goals and where you'd like to be in retirement.

- We'll find out more about your current financial situation.

- We'll walk you through step-by-step how we build a Property Strategy that gets you to where you want to be.

- We'll share our top investment opportunities, including what to buy, where to buy, and when.

- Tax Planning, Finance Structures, Cash Flow Analysis, Portfolio Growth, Property Selection and more - how our expert team takes care of it all.

- We'll answer any & all of your property investment questions!

If we determine that NIA can help you, and it feels like a great fit for you too…

We’ll give you the option of having us create a custom-designed Property Investment Portfolio Plan using our proven L.E.A.P. framework.

It’s a complete step-by-step playbook for building wealth with property and retiring in style.

So you have clarity and confidence in your future.

We’ve already helped over 500 Australian families use property to build wealth.

Which means that you’ll tap into a proven framework, with an experienced team that puts your success first.

At NIA, you’re in safe hands.

On this page you’ll find a library of client success stories, property growth case studies, and raving client testimonials.

We’d love you to be next.

So please don’t delay.

Book your complimentary Property Wealth Strategy Session today while we still have slots available:

To your financial freedom,

WE DON'T HAVE A PROPERTY GROWTH CASE STUDY.

We have a library of them.

Yorkdale Estate

Ballarat, VIC

House & Land

4

2

2

Property size

200m2

484m2

Purchase Price

$444,050

Oct 2019

New Valuation

$600,000

Oct 2021

Income

$410pw

Gross Yield

4.80%

WEEKLY

Capital Growth

$1,500

INCREASE

$155,950

Gulawa Rise Estate, Highfields

Toowoomba, QLD

House & Land

4

2

2

Property size

576m2

201m2

Purchase Price

$555,000

Jan 2022

New Valuation

$655,000

Feb 2023

Income

$620pw

Gross Yield

5.81%

WEEKLY

Capital Growth

$1,709

INCREASE

$100,000

Ravensfield Estate

Farley, NSW

Duplex House & Land

8

4

4

Property size

308m2

635m2

Purchase Price

$748,000

Oct 2019

New Valuation

$1.15M

Oct 2021

Income

$490pw (x2)

Gross Yield

6.81%

WEEKLY

Capital Growth

$3,865

INCREASE

$402,000

Surrounds Estate, Helensvale

Gold Coast, QLD

House & Land

5

2.5

2

Property size

230m2

425m2

Purchase Price

$650,000

July 2017

New Valuation

$1.15M

Nov 2021

Income

$770pw

Gross Yield

6.16%

WEEKLY

Capital Growth

$2,403

INCREASE

$500,000

Zeally Sands Estate

Torquay, VIC

House & Land

4

2

2

Property size

233m2

476m2

Purchase Price

$725,000

July 2018

New Valuation

$950,000

Sept 2021

Income

$600pw

Gross Yield

4.3%

WEEKLY

Capital Growth

$1,442

INCREASE

$225,000

Armstrong Estate

Mount Duneed, VIC

House & Land

4

2

2

Property size

200m2

512m2

Purchase Price

$511,250

Mar 2017

New Valuation

$755,000

Nov 2021

Income

$460pw

Gross Yield

4.63%

WEEKLY

Capital Growth

$1,560

INCREASE

$243,750

Yaringa Estate

Mount Duneed, VIC

House & Land

4

2

2

Property size

213m2

378m2

Purchase Price

$581,900

Mar 2021

New Valuation

$650,000

Nov 2021

Income

$480pw

Gross Yield

4.3%

WEEKLY

Capital Growth

$2,128

INCREASE

$68,100

Aura Estate (Bells Creek)

Sunshine Coast, QLD

House & Land

4

2

2

Property size

242m2

364m2

Purchase Price

$572,900

July 2020

New Valuation

$660,000

Sep 2021

Income

$580pw

Gross Yield

5.3%

WEEKLY

Capital Growth

$1,675

INCREASE

$87,100

Flora Estate

Joyner, Brisbane, QLD

House & Land

4

2

2

Property size

245m2

300m2

Purchase Price

$579,900

Dec 2020

New Valuation

$679,000

Dec 2021

Income

$600pw

Gross Yield

5.38%

WEEKLY

Capital Growth

$2,000

INCREASE

$99,100

Sanctuary View Estate

Fletcher, Newcastle, NSW

House & Land

4

2

2

Property size

218m2

488m2

Purchase Price

$641,990

April 2019

New Valuation

$880,000

Dec 2021

Income

$565pw

Gross Yield

4.6%

WEEKLY

Capital Growth

$3,051

INCREASE

$238,010

Mandalay Estate

Beveridge, VIC

House & Land

4

2

2

Property size

195m2

375m2

Purchase Price

$541,000

May 2019

New Valuation

$640,000

Dec 2021

Income

$410pw

Gross Yield

3.95%

WEEKLY

Capital Growth

$1,269

INCREASE

$99,000

Aurora Estate

Wollert, VIC

House & Land

4

2

2

Property size

195m2

403m2

Purchase Price

$486,500

May 2016

New Valuation

$650,000

Oct 2021

Income

$450pw

Gross Yield

4.8%

WEEKLY

Capital Growth

$628

INCREASE

$163,500

Covella Estate

Greenbank, QLD

House & Land

4

2

2

Property size

210m2

484m2

Purchase Price

$459,000

Mar 2019

New Valuation

$550,000

Nov 2021

Income

$480pw

Gross Yield

5.44%

WEEKLY

Capital Growth

$1,166

INCREASE

$91,000

Signature on Arana

Arana Hills, QLD

Townhouse

4

2.5

2

Property size

180m2

250m2

Purchase Price

$585,000

Nov 2020

New Valuation

$650,000

Dec 2021

Income

$600pw

Gross Yield

5.33%

WEEKLY

Capital Growth

$826

INCREASE

$64,500

Harmony Estate, Palmview

Sunshine Coast, QLD

House & Land

4

2

2

Property size

203m2

375m2

Purchase Price

$545,000

Mar 2019

New Valuation

$720,000

Nov 2021

Income

$550pw

Gross Yield

5.25%

WEEKLY

Capital Growth

$2,243

INCREASE

$175,000

Everton Breeze

Everton Hills, QLD

Townhouse

3

2.5

2

Property size

117m2

173m2

Purchase Price

$524,500

Nov 2019

New Valuation

$625,000

Dec 2021

Income

$590pw

Gross Yield

5.85%

WEEKLY

Capital Growth

$966

INCREASE

$100,500

Bloom Estate

Clyde North, VIC

House & Land

4

2

2

Property size

207m2

392m2

Purchase Price

$576,900

Oct 2018

New Valuation

$765,000

Dec 2021

Income

$460pw

Gross Yield

4.15%

WEEKLY

Capital Growth

$1,206

INCREASE

$188,100

Hawdon Street

Heidelberg, VIC

Townhouse

3

3

2

Property size

119m2

131m2

Purchase Price

$870,000

Jan 2018

New Valuation

$1.01M

Dec 2021

Income

$560pw

Gross Yield

3.35%

WEEKLY

Capital Growth

$897

INCREASE

$140,000

Armstrong Waters Estate

Armstrong Creek, VIC

House & Land

4

2

2

Property size

210m2

395m2

Purchase Price

$560,000

Mar 2020

New Valuation

$700,000

Jan 2022

Income

$500pw

Gross Yield

4.64%

WEEKLY

Capital Growth

$1,346

INCREASE

$140,000

West Wallsend

Newcastle, NSW

House & Land

4

2

2

Property size

220m2

666m2

Purchase Price

$552,000

Sep 2017

New Valuation

$970,000

Feb 2022

Income

$570pw

Gross Yield

5.37%

WEEKLY

Capital Growth

$1433

INCREASE

$298,000

Yaringa Estate

Mount Dundeed, VIC

House & Land

4

2

2

Property size

208m2

431m2

Purchase Price

$586,000

Feb 2021

New Valuation

$740,000

Feb 2022

Income

$500pw

Gross Yield

4.44%

WEEKLY

Capital Growth

$2,961

INCREASE

$154,000

NIA's impact

Client Success Story

Ed & Joanne

A successful portfolio across Victoria, New South Wales & Queensland

Ed & Joanne’s financials before they met NIA:

Ed and Joanne, both in their 50s, have been married for years and had two teenage daughters in high school. As a Procurement Manager and a Teacher, they had a combined household income of $275,000… which sounds good on paper, but they were paying more than $78,000 in tax from their salaries and still had $250,000 to pay on the mortgage on their home, now worth $900,000.

In order to ensure they could comfortably retire by the time they were 65 with complete financial freedom, Ed and Joanne knew they needed to speed-up the growth of their wealth.

So they called NIA.

How NIA helped make things much better

- 6 properties across Victoria, New South Wales & Queensland

- Enough growth & cash flow to maintain borrowing capacity

- Recycling equity back into expanding their property portfolio

- Renovated their entire home

- Paid off their mortgage ahead of time

- Eliminated all non-deductible debt

- Running a reliably positive cash flow status

- Saving more than $30k every year on tax

- Portfolio now worth more than $3million with 4.5% average yield

Ed & Joanne’s portfolio after just 5 years with NIA

Client Success Story

Jennifer & Andrew

Showing how Self-Managed Super Funds should be done

Jennifer & Andrew’s financials before they met NIA:

Jennifer and Andrew were 45 years of age and married with two children under 10. As a Financial Controller and IT Project Manager their combined household income was $250,000. They had zero investments and were paying over $50,000 a year in tax. They were unhappy with the investment returns from their Super and any progress in life was being hindered by a $300k mortgage.

The couple’s dream was to retire early without one single money worry, and they realised that to get there they would need some expert strategic advice.

A friend-of-a-friend referred them to NIA.

How NIA helped make things much better

Using NIA’s powerful financial strategies in property, finance, cash flow and wealth building, Jennifer and Andrew now have things completely under control and are comfortably looking forward to their dream early retirement.

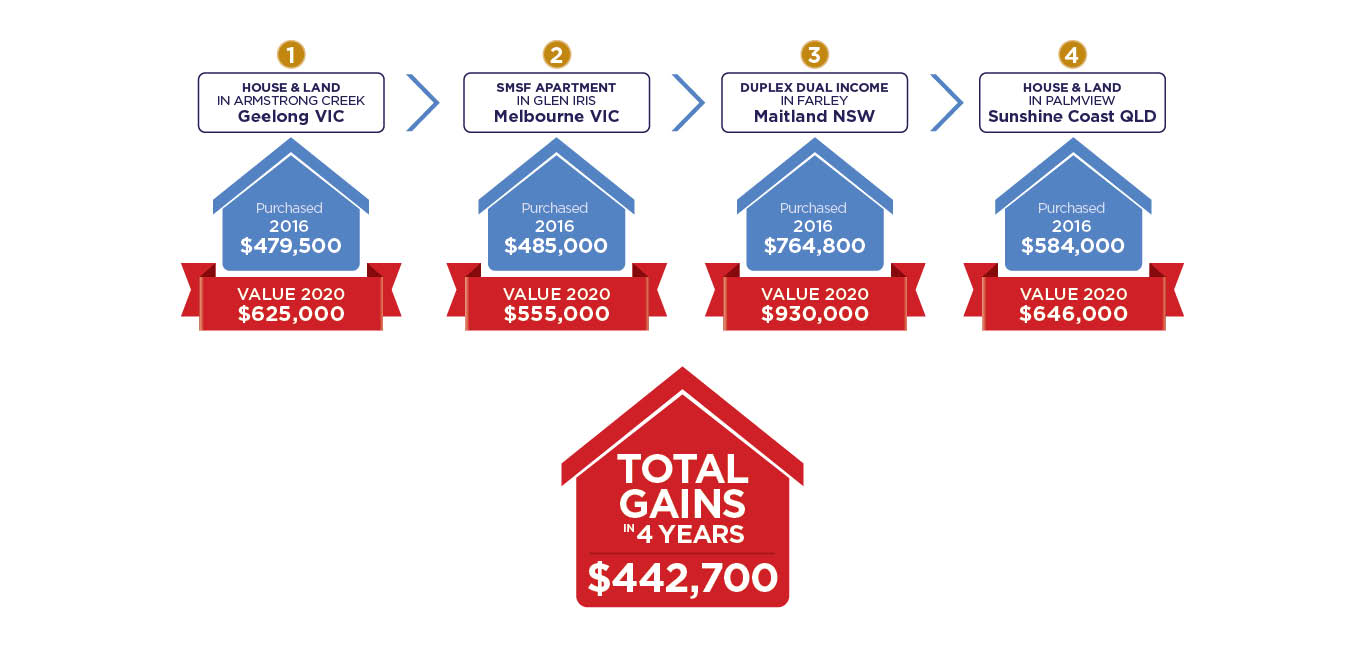

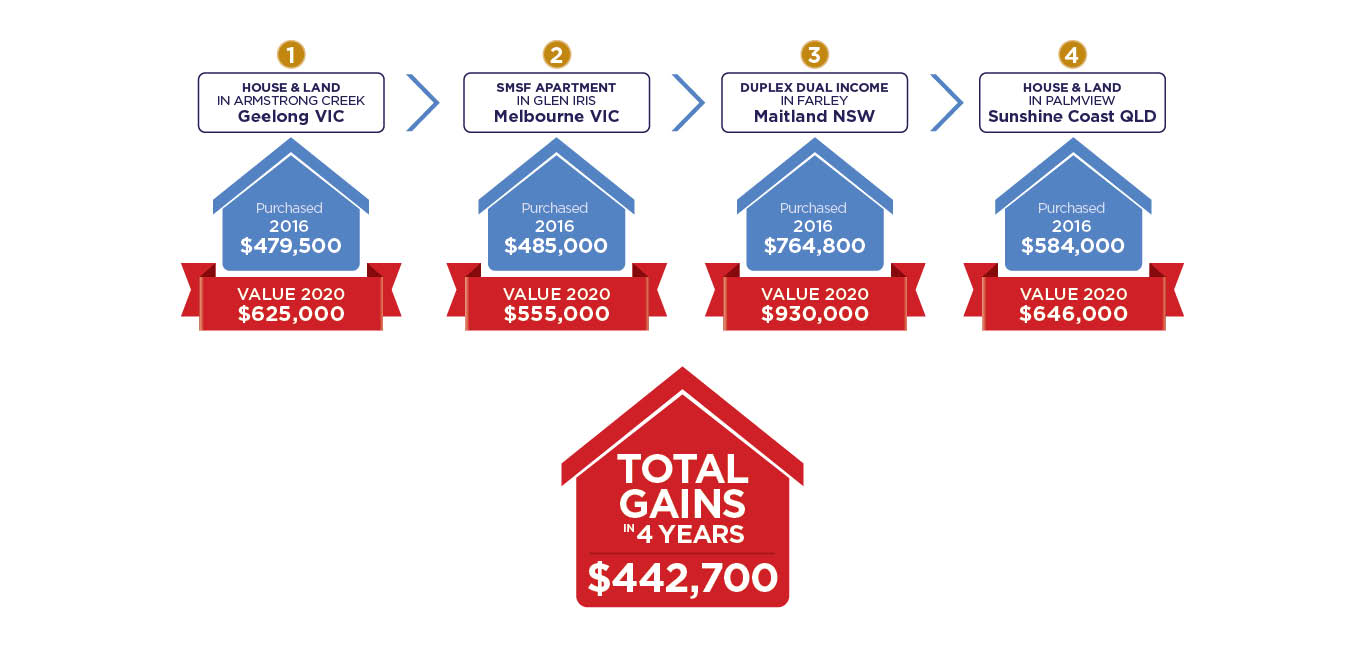

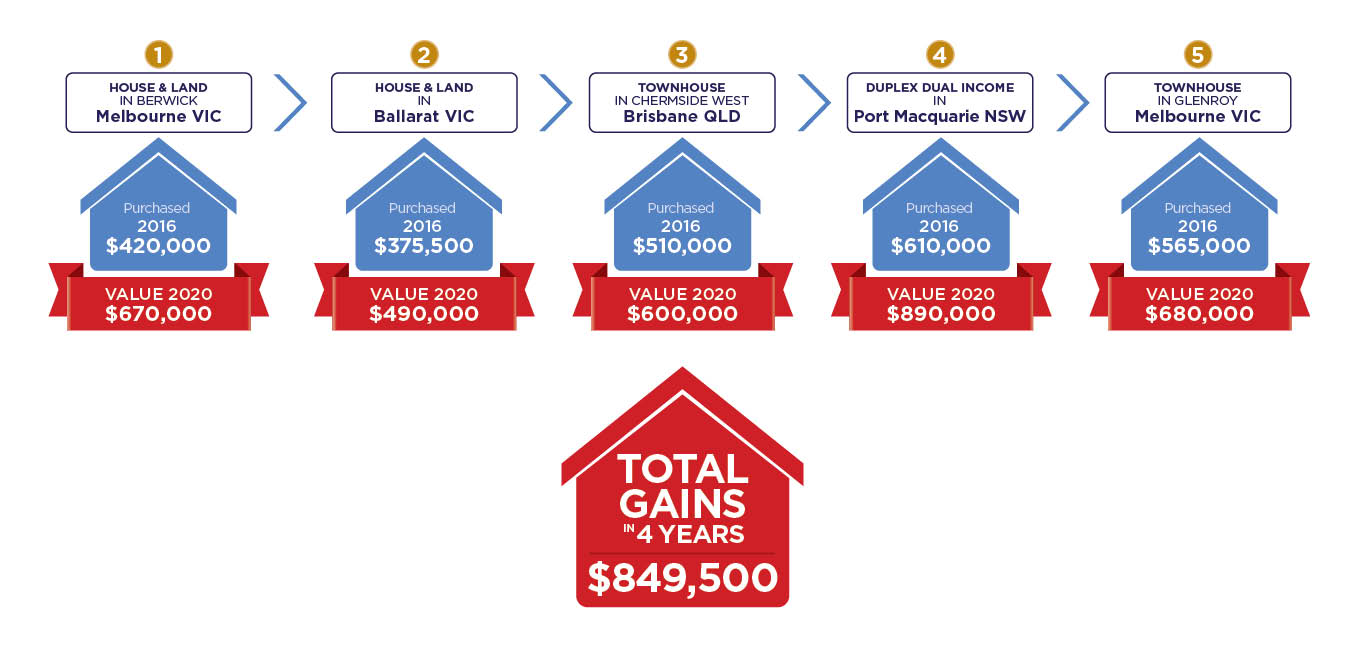

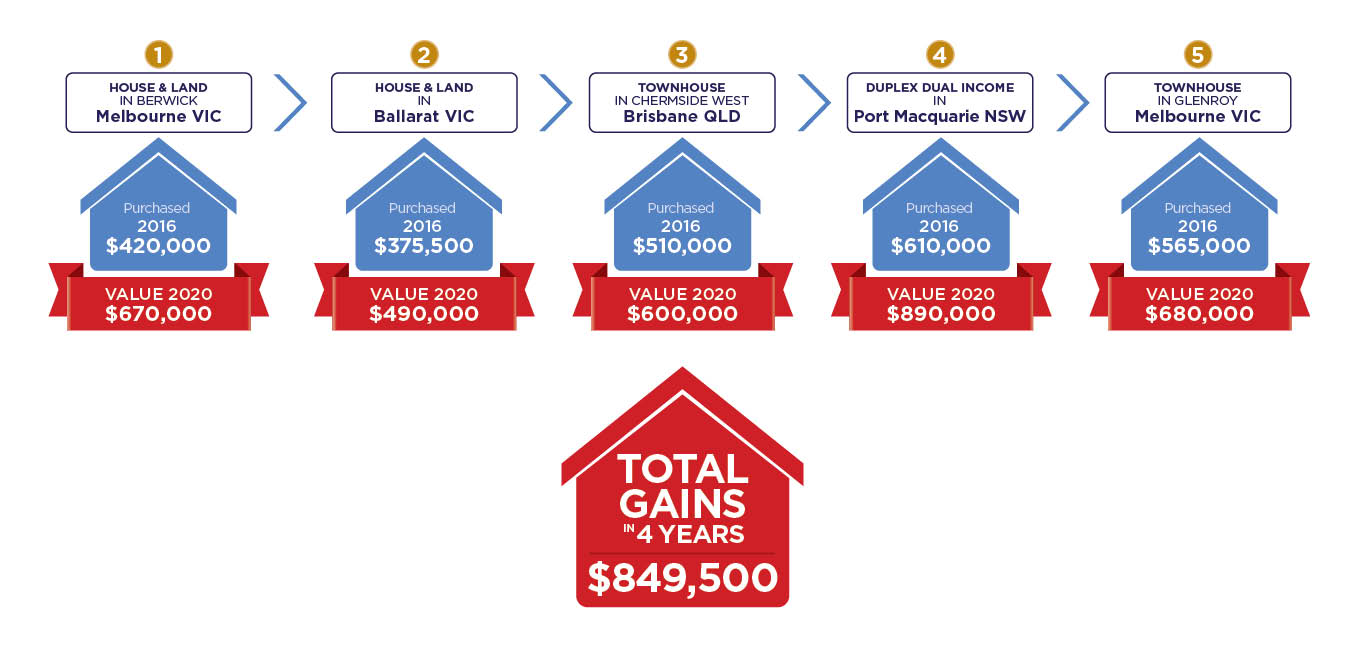

Just look at where they got to in only 4 years with NIA:

- They now have 5 investment properties

- Significantly increased returns to their Self-Managed Super

- They successfully manufactured an equity uplift on a duplex of over $200k

- They have reduced their tax bill by 50%

- They are on track to pay off their mortgage 14 years sooner

Jennifer & Andrew's portfolio after just 4 years with NIA

Client Success Story

Chris & Nancy

The dream team scoring multi-million dollar goals in property

Chris & Nancy’s financials before they met NIA:

Chris and Nancy were in their late 30s with two young kids, working hard as an IT Manager and Finance Manager respectively to bring in a combined income of $240,000. They were paying a crippling $52k in tax, being financially stifled by a $200k mortgage, and had a $300k Super fund sitting there not doing much at all.

Their dream was to pay less tax, build a multi-million dollar property portfolio, set up early retirement and an abundant future for the kids. They wanted to generate enough wealth to renovate their own home, and buy more investment properties, without draining their personal cash flow.

NIA helped them turn those dreams into reality.

How NIA helped make things much better

Using NIA’s renowned “LEAP Roadmap”, Chris and Nancy realised how quickly their dream financial scenario could become their reality. Thanks to their newly optimised tax structure and intelligent investment strategy, they gained the financial power to build a brilliant property portfolio with an average gross yield of 4.75%, while still enjoying enough cash flow to live their best life.

Have a look at where they are now after just 4 years with NIA:

- 4 properties yielding on average 4.75%

- Mortgage paid off 12 years sooner

- Paying $28k less tax

- Set for early retirement at age 50

- Re-structured Super to increase earnings by 15%

Chris & Nancy's portfolio after just 4 years with NIA