⏱️ Your eBook will be in your email inbox in a moment.

In the meantime...

Claim your complimentary Property Wealth Strategy Session below 👇

SESSIONS STILL AVAILABLE

DISCOVER IN A FREE PROPERTY WEALTH STRATEGY SESSION:

How we help Aussie families retire wealthy using property.

Slash tax. Cut years off your mortgage. Build real wealth.

Secure your complimentary 60 minute 1:1 session:

EXPERIENCE

With 18+ years experience, NIA have proudly helped over 500 Aussie families build the kind of wealth that gives their grandchildren an advantage in life.

CONFIDENCE

SUPPORT

AS FEATURED IN

Will you be toasting to the good life?

Retirement spent celebrating, or stressing?

May 10, 2025

Or it’s something as simple as being able to afford a holiday home. Having BBQs with your kids. Watching the grand kids grow up.

Maybe for you, it’s having the power to decide for yourself:

To work, or not work.

Freedom from worrying about bills coming in.

Feeling safe, secure and in control of your financial situation.

Yet this is exactly the kind of opportunity that Australia’s property market presents us with right now.

But it is a time sensitive opportunity.

The longer you sit on the sidelines, the more difficult success becomes.

We’re here to make sure you’re not one of them.

Here’s the thing you must know.

- We'll understand your financial goals and where you'd like to be in retirement.

- We'll find out more about your current financial situation.

- We'll walk you through step-by-step how we build a Property Strategy that gets you to where you want to be.

- We'll share our top investment opportunities, including what to buy, where to buy, and when.

- Tax Planning, Finance Structures, Cash Flow Analysis, Portfolio Growth, Property Selection and more - how our expert team takes care of it all.

- We'll answer any & all of your property investment questions!

If we determine that NIA can help you, and it feels like a great fit for you too…

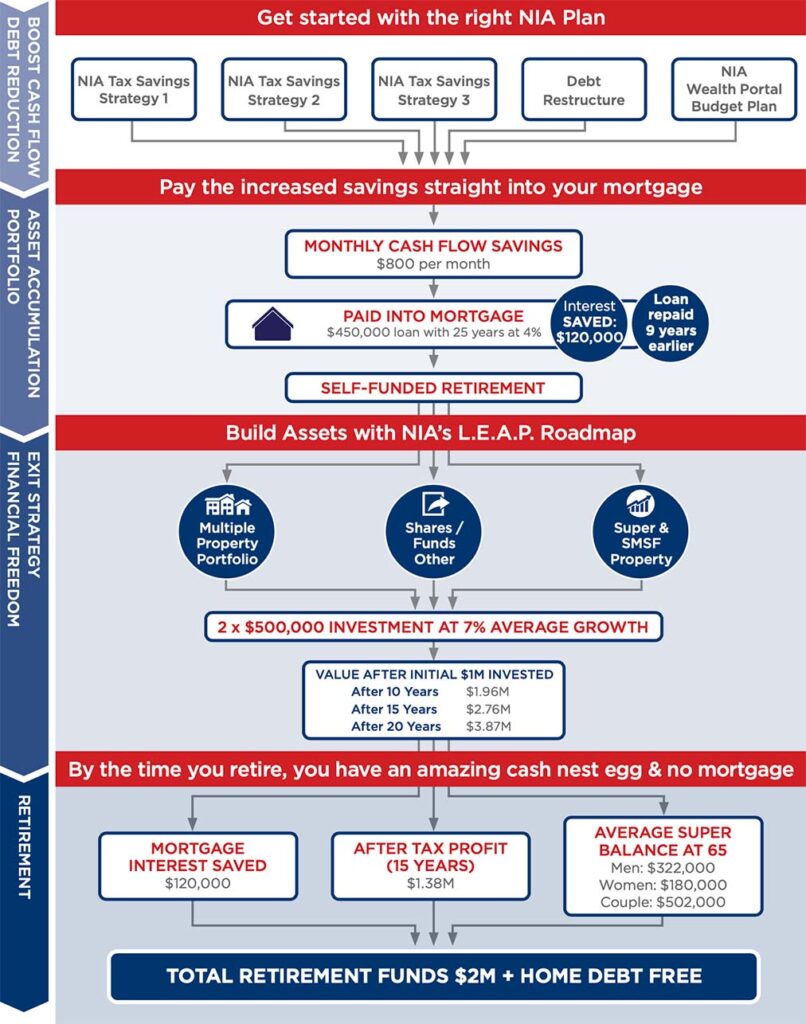

We’ll give you the option of having us create a custom-designed Property Investment Portfolio Plan using our proven L.E.A.P. framework.

It’s a complete step-by-step playbook for building wealth with property and retiring in style.

So you have clarity and confidence in your future.

We’ve already helped over 500 Australian families use property to build wealth.

Which means that you’ll tap into a proven framework, with an experienced team that puts your success first.

At NIA, you’re in safe hands.

On this page you’ll find a library of client success stories, property growth case studies, and raving client testimonials.

We’d love you to be next.

So please don’t delay.

Book your complimentary Property Wealth Strategy Session today while we still have slots available:

To your financial freedom,

WE DON'T HAVE A PROPERTY GROWTH CASE STUDY.

We have a library of them.

Yorkdale Estate

Ballarat, VIC

House & Land

4

2

2

Property size

200m2

484m2

Purchase Price

$444,050

Oct 2019

New Valuation

$600,000

Oct 2021

Income

$410pw

Gross Yield

4.80%

WEEKLY

Capital Growth

$1,500

INCREASE

$155,950

Gulawa Rise Estate, Highfields

Toowoomba, QLD

House & Land

4

2

2

Property size

576m2

201m2

Purchase Price

$555,000

Jan 2022

New Valuation

$655,000

Feb 2023

Income

$620pw

Gross Yield

5.81%

WEEKLY

Capital Growth

$1,709

INCREASE

$100,000

Ravensfield Estate

Farley, NSW

Duplex House & Land

8

4

4

Property size

308m2

635m2

Purchase Price

$748,000

Oct 2019

New Valuation

$1.15M

Oct 2021

Income

$490pw (x2)

Gross Yield

6.81%

WEEKLY

Capital Growth

$3,865

INCREASE

$402,000

Surrounds Estate, Helensvale

Gold Coast, QLD

House & Land

5

2.5

2

Property size

230m2

425m2

Purchase Price

$650,000

July 2017

New Valuation

$1.15M

Nov 2021

Income

$770pw

Gross Yield

6.16%

WEEKLY

Capital Growth

$2,403

INCREASE

$500,000

Zeally Sands Estate

Torquay, VIC

House & Land

4

2

2

Property size

233m2

476m2

Purchase Price

$725,000

July 2018

New Valuation

$950,000

Sept 2021

Income

$600pw

Gross Yield

4.3%

WEEKLY

Capital Growth

$1,442

INCREASE

$225,000

Armstrong Estate

Mount Duneed, VIC

House & Land

4

2

2

Property size

200m2

512m2

Purchase Price

$511,250

Mar 2017

New Valuation

$755,000

Nov 2021

Income

$460pw

Gross Yield

4.63%

WEEKLY

Capital Growth

$1,560

INCREASE

$243,750

Yaringa Estate

Mount Duneed, VIC

House & Land

4

2

2

Property size

213m2

378m2

Purchase Price

$581,900

Mar 2021

New Valuation

$650,000

Nov 2021

Income

$480pw

Gross Yield

4.3%

WEEKLY

Capital Growth

$2,128

INCREASE

$68,100

Aura Estate (Bells Creek)

Sunshine Coast, QLD

House & Land

4

2

2

Property size

242m2

364m2

Purchase Price

$572,900

July 2020

New Valuation

$660,000

Sep 2021

Income

$580pw

Gross Yield

5.3%

WEEKLY

Capital Growth

$1,675

INCREASE

$87,100

Flora Estate

Joyner, Brisbane, QLD

House & Land

4

2

2

Property size

245m2

300m2

Purchase Price

$579,900

Dec 2020

New Valuation

$679,000

Dec 2021

Income

$600pw

Gross Yield

5.38%

WEEKLY

Capital Growth

$2,000

INCREASE

$99,100

Sanctuary View Estate

Fletcher, Newcastle, NSW

House & Land

4

2

2

Property size

218m2

488m2

Purchase Price

$641,990

April 2019

New Valuation

$880,000

Dec 2021

Income

$565pw

Gross Yield

4.6%

WEEKLY

Capital Growth

$3,051

INCREASE

$238,010

Mandalay Estate

Beveridge, VIC

House & Land

4

2

2

Property size

195m2

375m2

Purchase Price

$541,000

May 2019

New Valuation

$640,000

Dec 2021

Income

$410pw

Gross Yield

3.95%

WEEKLY

Capital Growth

$1,269

INCREASE

$99,000

Aurora Estate

Wollert, VIC

House & Land

4

2

2

Property size

195m2

403m2

Purchase Price

$486,500

May 2016

New Valuation

$650,000

Oct 2021

Income

$450pw

Gross Yield

4.8%

WEEKLY

Capital Growth

$628

INCREASE

$163,500

Covella Estate

Greenbank, QLD

House & Land

4

2

2

Property size

210m2

484m2

Purchase Price

$459,000

Mar 2019

New Valuation

$550,000

Nov 2021

Income

$480pw

Gross Yield

5.44%

WEEKLY

Capital Growth

$1,166

INCREASE

$91,000

Signature on Arana

Arana Hills, QLD

Townhouse

4

2.5

2

Property size

180m2

250m2

Purchase Price

$585,000

Nov 2020

New Valuation

$650,000

Dec 2021

Income

$600pw

Gross Yield

5.33%

WEEKLY

Capital Growth

$826

INCREASE

$64,500

Harmony Estate, Palmview

Sunshine Coast, QLD

House & Land

4

2

2

Property size

203m2

375m2

Purchase Price

$545,000

Mar 2019

New Valuation

$720,000

Nov 2021

Income

$550pw

Gross Yield

5.25%

WEEKLY

Capital Growth

$2,243

INCREASE

$175,000

Everton Breeze

Everton Hills, QLD

Townhouse

3

2.5

2

Property size

117m2

173m2

Purchase Price

$524,500

Nov 2019

New Valuation

$625,000

Dec 2021

Income

$590pw

Gross Yield

5.85%

WEEKLY

Capital Growth

$966

INCREASE

$100,500

Bloom Estate

Clyde North, VIC

House & Land

4

2

2

Property size

207m2

392m2

Purchase Price

$576,900

Oct 2018

New Valuation

$765,000

Dec 2021

Income

$460pw

Gross Yield

4.15%

WEEKLY

Capital Growth

$1,206

INCREASE

$188,100

Hawdon Street

Heidelberg, VIC

Townhouse

3

3

2

Property size

119m2

131m2

Purchase Price

$870,000

Jan 2018

New Valuation

$1.01M

Dec 2021

Income

$560pw

Gross Yield

3.35%

WEEKLY

Capital Growth

$897

INCREASE

$140,000

Armstrong Waters Estate

Armstrong Creek, VIC

House & Land

4

2

2

Property size

210m2

395m2

Purchase Price

$560,000

Mar 2020

New Valuation

$700,000

Jan 2022

Income

$500pw

Gross Yield

4.64%

WEEKLY

Capital Growth

$1,346

INCREASE

$140,000

West Wallsend

Newcastle, NSW

House & Land

4

2

2

Property size

220m2

666m2

Purchase Price

$552,000

Sep 2017

New Valuation

$970,000

Feb 2022

Income

$570pw

Gross Yield

5.37%

WEEKLY

Capital Growth

$1433

INCREASE

$298,000

Yaringa Estate

Mount Dundeed, VIC

House & Land

4

2

2

Property size

208m2

431m2

Purchase Price

$586,000

Feb 2021

New Valuation

$740,000

Feb 2022

Income

$500pw

Gross Yield

4.44%

WEEKLY

Capital Growth

$2,961

INCREASE

$154,000

NIA's impact

Client Success Story

Ed & Joanne

A successful portfolio across Victoria, New South Wales & Queensland

Ed & Joanne’s financials before they met NIA:

Ed and Joanne, both in their 50s, have been married for years and had two teenage daughters in high school. As a Procurement Manager and a Teacher, they had a combined household income of $275,000… which sounds good on paper, but they were paying more than $78,000 in tax from their salaries and still had $250,000 to pay on the mortgage on their home, now worth $900,000.

In order to ensure they could comfortably retire by the time they were 65 with complete financial freedom, Ed and Joanne knew they needed to speed-up the growth of their wealth.

So they called NIA.

How NIA helped make things much better

- 6 properties across Victoria, New South Wales & Queensland

- Enough growth & cash flow to maintain borrowing capacity

- Recycling equity back into expanding their property portfolio

- Renovated their entire home

- Paid off their mortgage ahead of time

- Eliminated all non-deductible debt

- Running a reliably positive cash flow status

- Saving more than $30k every year on tax

- Portfolio now worth more than $3million with 4.5% average yield

Ed & Joanne’s portfolio after just 5 years with NIA

Client Success Story

Jennifer & Andrew

Showing how Self-Managed Super Funds should be done

Jennifer & Andrew’s financials before they met NIA:

Jennifer and Andrew were 45 years of age and married with two children under 10. As a Financial Controller and IT Project Manager their combined household income was $250,000. They had zero investments and were paying over $50,000 a year in tax. They were unhappy with the investment returns from their Super and any progress in life was being hindered by a $300k mortgage.

The couple’s dream was to retire early without one single money worry, and they realised that to get there they would need some expert strategic advice.

A friend-of-a-friend referred them to NIA.

How NIA helped make things much better

Using NIA’s powerful financial strategies in property, finance, cash flow and wealth building, Jennifer and Andrew now have things completely under control and are comfortably looking forward to their dream early retirement.

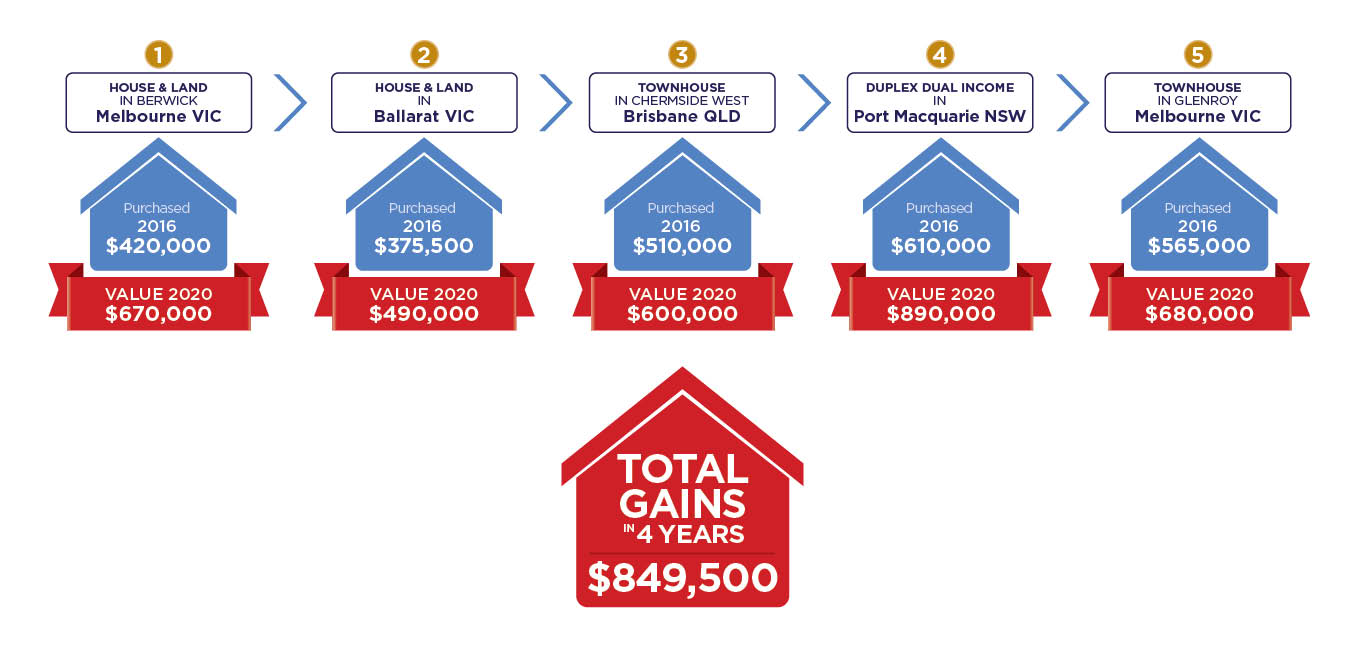

Just look at where they got to in only 4 years with NIA:

- They now have 5 investment properties

- Significantly increased returns to their Self-Managed Super

- They successfully manufactured an equity uplift on a duplex of over $200k

- They have reduced their tax bill by 50%

- They are on track to pay off their mortgage 14 years sooner

Jennifer & Andrew's portfolio after just 4 years with NIA

Client Success Story

Chris & Nancy

The dream team scoring multi-million dollar goals in property

Chris & Nancy’s financials before they met NIA:

Chris and Nancy were in their late 30s with two young kids, working hard as an IT Manager and Finance Manager respectively to bring in a combined income of $240,000. They were paying a crippling $52k in tax, being financially stifled by a $200k mortgage, and had a $300k Super fund sitting there not doing much at all.

Their dream was to pay less tax, build a multi-million dollar property portfolio, set up early retirement and an abundant future for the kids. They wanted to generate enough wealth to renovate their own home, and buy more investment properties, without draining their personal cash flow.

NIA helped them turn those dreams into reality.

How NIA helped make things much better

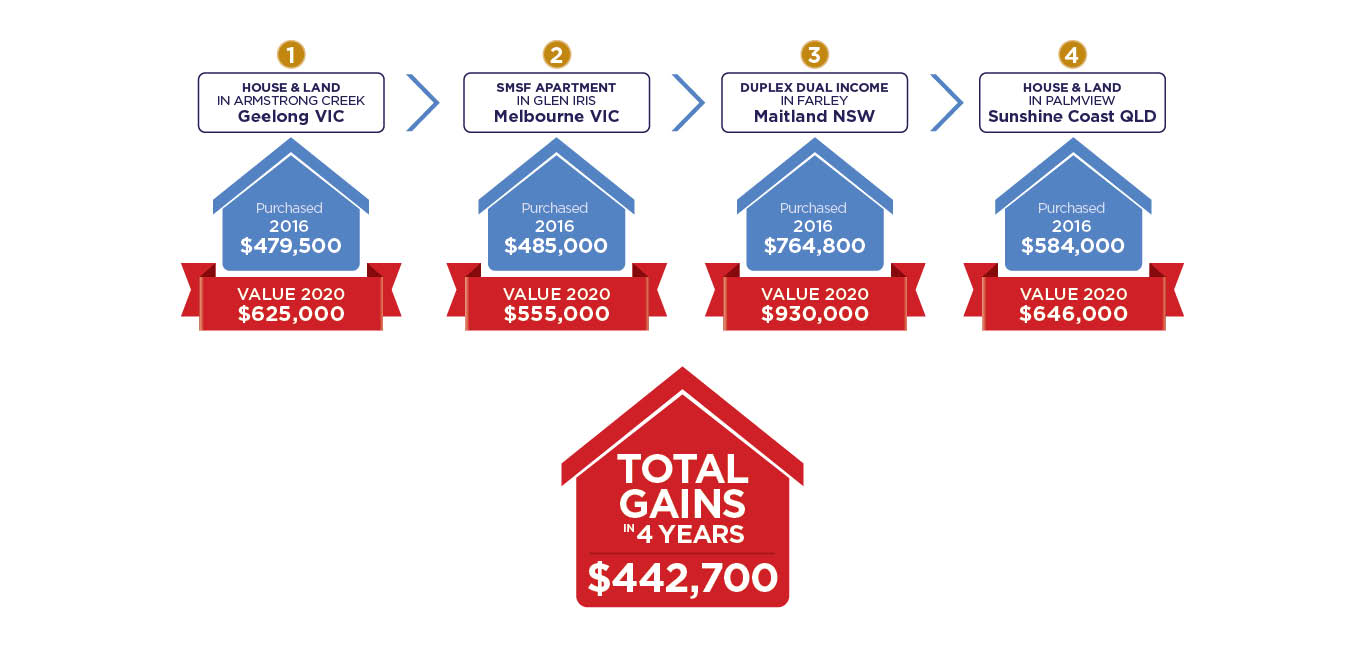

Using NIA’s renowned “LEAP Roadmap”, Chris and Nancy realised how quickly their dream financial scenario could become their reality. Thanks to their newly optimised tax structure and intelligent investment strategy, they gained the financial power to build a brilliant property portfolio with an average gross yield of 4.75%, while still enjoying enough cash flow to live their best life.

Have a look at where they are now after just 4 years with NIA:

- 4 properties yielding on average 4.75%

- Mortgage paid off 12 years sooner

- Paying $28k less tax

- Set for early retirement at age 50

- Re-structured Super to increase earnings by 15%

Chris & Nancy's portfolio after just 4 years with NIA

EXCELLENTTrustindex verifies that the original source of the review is Google. We struggled to find an investment property for a year or two, constantly being outbid by people overpaying for their family’s home. We then found NIA and Matt was able to clearly explain the financial benefits of building and assuage any fears we had about the building process. The information they compiled on each potential property was extensive, including private and Government development planned in the surrounding area and new services that would affect future property prices. Matt and the team held our hands through the entire build process and the growth we achieved in one year before the property was even completed far outstripped what we could have made on purchasing an existing property. A rental contract was signed a month before completion. We’re now lining things up for purchase number two in our strategic 10 year plan, thanks to the NIA team.Trustindex verifies that the original source of the review is Google. Professionalism and honesty is at its best. So resourceful, trustworthy, result oriented and hardworking people in this company. Thank you for your service and help especially to Ben Stuckey, for all the guidance and dedication to get us this investment portfolio starting and materialized at this stage. Looking forward for more.Trustindex verifies that the original source of the review is Google. Great support from Matt and the team on understanding my financial goals and finding the right properties to suit my family's plan. Even in ambiguous situations they always provided me with expertise and confidence to manage builders, keeping us close to what was originally planned. Also supporting during the lease process and support on the many questions I had with the first phase of the properties we acquired. Now we are embarking on the phase 2, I can already see them adjusting their approach to my changing needs. Highly recommend!Trustindex verifies that the original source of the review is Google. I have worked closely with Matt and his team from NIA for the last 18 mths. Up front they stepped me through the property investment process and how this would benefit me in terms of my financial goals. Once we settled on an investment property to purchase, NIA where there throughout the whole buying/build and settlement process. NIA are a highly professional team who operates with integrity and focus. Thank you for all your great support. Cheers, Glenn and SvetaTrustindex verifies that the original source of the review is Google. I am so happy I did my research and found Matt Bower and his team at NIA. With the help of Matt and his impressive expertise as a property strategist and mentor, I have purchased 2 properties dual purchase strategy through NIA. Now put me in a strong position to secure my third investment. Matt’s knowledge & support is amazing and my investment journey with his help has been a smooth process. Matt, Geoff, and the team guided me every step of the way and answered all my questions to give me confidence that I found a trusted partner to help me move ahead. Having Matt’s finance and property expertise combined with the NIA finance team and their specialist mortgage planner Troy Marchmont. It made the numbers so simple, easy, and safe to move forward with affordable options. I would highly recommend National Investment Advisory for anyone thinking about buying an investment property. You are in safe hands!Trustindex verifies that the original source of the review is Google. Matt Bower and his team of advisors (including mortgage broker, Troy Marchmont) have been a joy to deal with. From my experience of working with them in the months leading up to the purchase and until now, they have been professional, knowledgeable, approachable, accommodating of my busy work schedule and understanding of the jitters that a first-time investor would have. Two years on, they continue to reach out to discuss the continuation of the strategy laid out at the start of my working relationship with them. Looking forward to continuing my journey under Matt and his team's guidance.Trustindex verifies that the original source of the review is Google. This was our first time buying an investment property. The experience has been 5 star from the first phone call with Matt and his team until now. Our property had tenants lined up before the house was completed and at a higher weekly rent than originally expected. NIA does all the hard work, we just had to decide on the property, sign the documents and sit back and let it happen! Very professional team. Looking forward to working with Matt and the team in the future.Trustindex verifies that the original source of the review is Google. I have been working with Matt and the NIA team over the last couple of years with great results. We recently finished construction of a property on the Sunshine Coast with tenants sourced in under a week and well over the expected rental yield. There has also been considerable capital growth consistent with the advice Matt provided. The team presented well detailed advise on multiple properties and supported all aspects of the project including finance, planning, build oversight and appointment of property managers. I will happily work with Matt and the team in the future.Trustindex verifies that the original source of the review is Google. Matt and Geoff at NIA were absolutely amazing. Selecting an investment property during COVID lockdown with the uncertainties and lack of expertise. It was nothing but confidence and reassurance. They have made our entire journey smooth and easy. When we are ready for our next investment, we will definitely use the team again.Trustindex verifies that the original source of the review is Google. Like anyone, I was hesitant when using a partner for real estate investments because there are so many "influencers" and noise out there. Just like using a mortgage broker to access better loan deal, NIA have access to better real estate deals than you could find alone! The truth is there is no one right strategy for all. Matt at the NIA will work out the right strategy for you. Geoff and the rest of the NIA team will help you every step of the way while being patient with first time investors. They do not promise inflated returns, they are conservative and realistic. Even with COVID-19 lockdowns and building supply constrains they manage to keep the builders on track, bringing in the project from start to finish in 10 months. I was fortunate to get the chance to wonder around the property after completion and the finish was excellent, it was not your typical bulk-built house. The timing may have been fortunate with the drastic increase in the property market in the last few years but the results that NIA produced are still more than I could have ever imagined. The result was $130 more rent per week than their original calculations, increasing the net rental yield of the property above the expected 3-4% and creating a positive cash flow, which is key for long term investing. The most impressive part was the capital growth, with an increase of $273,270 from purchase price to completed bank evaluation in less than 1 year, that is incredible. The NIA are truly the best at what they do.