For the smartest, simplest property wealth and investment strategies, the National Investment Advisory is your perfect partner.

When you engage NIA to help build your wealth, you’ll be working with a team of property professionals who specialise in helping first timers and established property investors alike, dedicated in the mission to boost your capital growth and cash flow – quickly.

Getting to know you and how you want to live is the first step to ensuring your financial success, because knowing you enables us to support you, educating you throughout your entire property and financial journey.

Put simply, we’re your property-savvy partner and we’re here to help you build wealth on the way to a lifestyle you really want.

Turn your income into wealth for life

What we do for you

Property wealth planners, focussed on your financial freedom

Building wealth for an early, well-funded retirement

Getting back into the black by eliminating your debt

Optimising tax to ensure compliance & lower payments

Comfortably affording quality education for your children

Creating lucrative multiple income streams

Having enough money to pursue all your passions

With a smart property investment advisory team by your side, life has no limits!

Services

To build wealth for life, start here

The National Investment Advisory is your perfect partner in building wealth, with a suite of proven property and investment strategies, powered by leading-edge industry expertise.

Financial Goals Planning

Whatever ‘living your best life’ looks like, we can help you make it happen. The first thing to do is plan out the route to get there, with an expert by your side who knows the way.

Property Wealth Planning

Wherever you’re at with property investing, when planning for maximum property growth, it pays to talk to a professional who has a finger on every pulse in the country.

Informed Finance Solutions

To successfully expand your property portfolio, you need the right structure in place. Our specialists ensure your financial strategy and products are flexible in the right places.

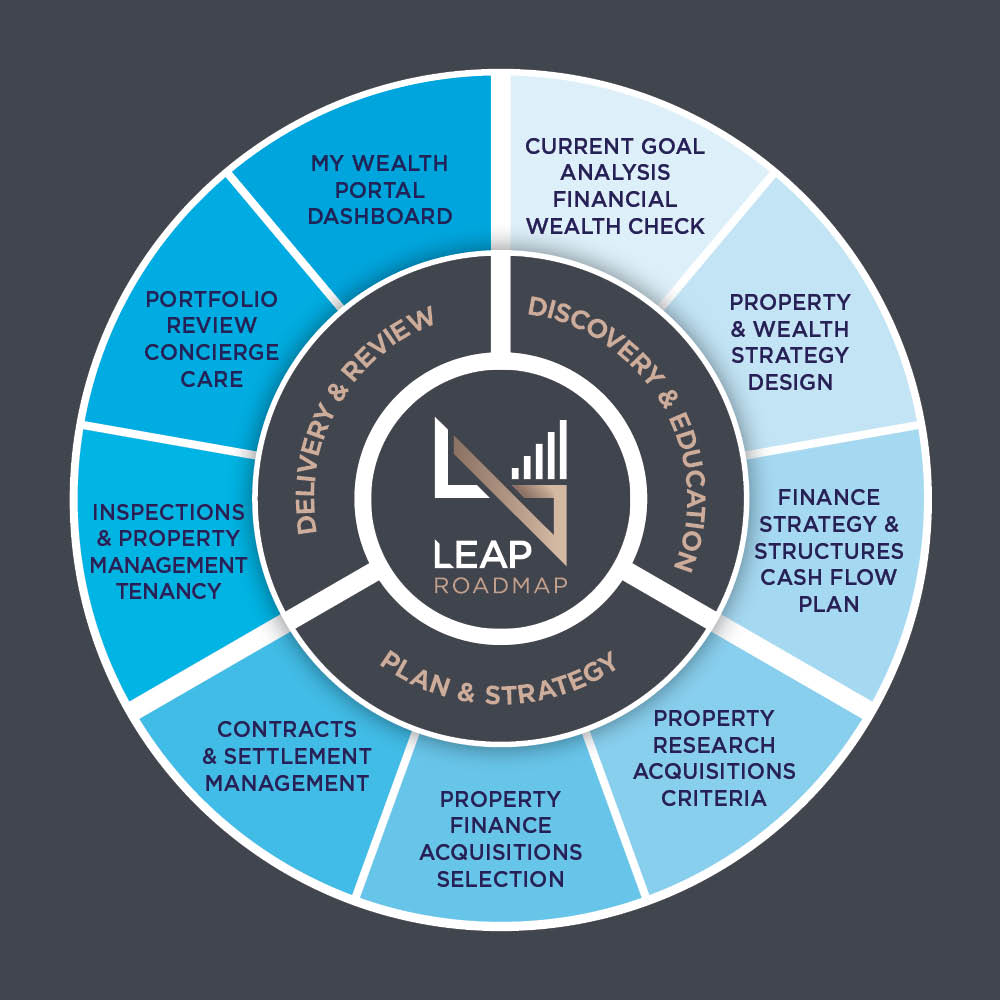

LEAP

Roadmap

Wherever you are in your financial journey, our LEAP Roadmap system is proven to ensure you live a secure, truly abundant life – more than 400 success stories and counting!

Self-Managed Super

Growing your Super is one of the best ways to freedom in retirement. NIA knows how to maximise Super returns, making sure your nest egg delivers financial abundance.

Your

Wealth Portal

See all of your property investments and financial solutions perform in real-time, in one place through our high-tech Wealth Portal – the fastest most user-friendly platform around.

NIA helped me build a sustainable multiple-property portfolio, supporting me like a partner with ongoing educational advice. They went way beyond the investment transaction, using their team’s combined expertise to ensure I scored my financial goals and started living my best life.

JAMIE HURST

Why NIA is one of Australia’s leading Property Investment Wealth Planners

We make your life easier

NIA offers a truly comprehensive solution, removing the guesswork and the risk involved in your property purchases - designed to deliver financial success, smoothly.

We partner with you all the way

End-to-end service is our blueprint, and we proudly offer a partnership that goes way beyond any transactions, staying by your side until you hit your financial targets.

We help ‘everyday’ Australians build wealth

If you’re motivated, we can help you build property wealth, by sharing our knowledge and research, applying proven strategies and providing ongoing, leading-edge support.

We get you access to every market

With NIA by your side you get access to property in any state, and we manage the whole process for you from viewing through to settlement.

We connect you to our panel of experts

With NIA you’ll be looked after by our national network of property-savvy partners, including solicitors, accountants, insurers, builders, lenders and property managers.

We prepare tailored Property Wealth Plans

Your NIA Property Wealth Plan is an expertly tailored strategy, applying leading-edge educational advice to your personal financials and aligning you for investment success.

We use leading research & acquisition data

The dedicated NIA research team studies the latest industry data, ensuring you get the right property, in the right place, for the right price, on the right terms.

We remove the worry about failure

Fear of making the wrong choice is often the thing that stops us making the right choice. NIA’s expertise puts your mind at ease - your success in property is our number one priority.

LEAP Roadmap

Your 6 simple steps to financial success

From first-time property buyers to people planning for retirement, our leading-edge LEAP Roadmap has helped more than 500 people just like you achieve a financially secure, truly abundant life.

Here’s how it works, in 6 simple steps.

STEP 1 - EMBRACE YOUR LEVERAGE

When you engage NIA, our priority is to teach you how to pay yourself first, helping you restructure your finances, find better deals and embrace newly found leverage to reduce stressful inefficiencies.

STEP 2 - USE YOUR EQUITY

Under-utilised equity in your home or other property assets is a huge opportunity. By investing your equity safely and securely, you can utilise it to produce great investment returns that build wealth fast.

STEP 3 - INCREASE YOUR EARNINGS

The fact is, you can make more money or create additional income opportunities, if you really want to and you know someone like us who can help you look. This means more leverage to build wealth faster

STEP 4 - MANAGE YOUR EMOTIONS

Property can be emotional, and when unchecked that emotion can cause poor decision making. With NIA you’ll have all the education and advice you need to clarify and solidify your purpose.

STEP 5 - GET SERIOUS ABOUT TAX

Using proven tax strategies will empower you with legislated cash incentives and ensure you avoid paying more than you need to. This used to be a game only for the wealthy, but not anymore.

STEP 6 - GET A PORTFOLIO PLAN

Planning a portfolio that will give you genuine, complete financial freedom requires clearly set goals and minimised risk. We’ll help you make a plan that’s tailored to your needs and ready to repeat.

The LEAP Roadmap transforms your income into capital growth & cash flow. Quickly!

With the right property wealth advisor, you can invest to build wealth with confidence.

The LEAP Roadmap has helped build big wealth for more than 500 investors & counting…

About Us

Life-changing passive income is our passion

If you’re a hard-working professional wanting help in your first property investment, or you’re already investing but want to build bigger, faster wealth, the National Investment Advisory was formed specially to help you hit your ‘dream’ financial success.

Our sole mission is to show you how to create secure passive wealth, larger capital, and maximised cash flow – delivering true financial freedom. NIA is not about getting rich quick, we guarantee stable, diversified, expertly planned strategies that precisely align with your goals.

The life you want is why we’re here!

I created the National Investment Advisory to help everyday Australians just like you secure a ‘dream’ financial future.

I paid $86k for my first property in my early 20s at an unimaginable 17% mortgage rate. I was horrified but also intrigued, and the experience began a life-long intellectual love for property & finance.

Over the years I’ve built a multi-million-dollar property portfolio using the proven strategies I’ve developed… please get in touch with me anytime and I’ll explain how we can do the same for you, too.

NIA Founder & Principal

NIA's impact

Equity Street Podcast

with Matt Bower

Your Roadmap to Property Wealth

Welcome to Equity Street where we answer the questions of real estate investors across Australia and provide the roadmap to property wealth.

Your questions are answered by Matt Bower, one of Australia’s leading property experts who has secured over $798 million in property across Australia for his clients.

Matt is also the founder and Managing Director of leading advisory firm National Investment Advisory.

LISTEN NOW ON:

LATEST PODCASTS:

Get in touch

CHOOSE SUCCESS TODAY, CALL NIA!

Your road to financial freedom starts here

Call: 1300 565 888

BOOK A FREE STRATEGY SESSION

Grab this priceless free session today, call NIA

Call: 1300 565 888

BOOK A FREE STRATEGY SESSION

Grab this priceless free session today, call NIA

Call: 1300 565 888

The National Investment Advisory specialises in helping people just like you make the right financial choices and restructuring decisions, to ensure you earn much more money across your property portfolio.

Your Free Strategy Session is our way of letting you know all the ways we can help.

No strings. No catches.

Just 60 minutes chatting with the experts about your future.

And that’s a promise.